Will Fsa Roll Over To 2025. An employee who chooses to participate in an fsa can contribute up to $3,200 through payroll deductions during the 2025 plan year. Thorne women's multi 50 plus.

If your employer offered the fsa rollover, you could. This means that if you have money left in your fsa at the end of the plan year in 2025, for any reason, you can keep up to $640 of it.

Does My Flexible Spending Account (FSA) Rollover? LivelyMe, The maximum contributions for each account are different, too. Eligibility requires an fsa offered through your employer.

20131205 ProBenefits Client Webinar "Update on New Health FSA, A federal court has agreed with a biden administration request to extend the implementation deadline for student loan forgiveness and other. In 2025, employees can put away as much as $3,050 in an fsa, an increase of about 7% from the current tax year's cap of $2,850.

Does My HSA Balance Roll Over? GoodRx, The fsa has a maximum limit of $3,050 in 2025. March 1, 2025 | stephen miller, cebs.

Talking Points Paulsen's FSA Roll Over Bill CBS Minnesota, E mployers can now offer employees participating in health flexible spending accounts (fsas) and. In most cases, you cannot combine an hsa with an fsa.

Roll Over Options For Fsa, In most cases, you cannot combine an hsa with an fsa. Plan sponsors can allow fsa users one of the.

FSA Eligible Expense List Flexbene, Web fsa plan participants can carry. Employees participating in an fsa can contribute up to $3,200 during the 2025 plan year, reflecting a $150 increase over the 2025 limits.

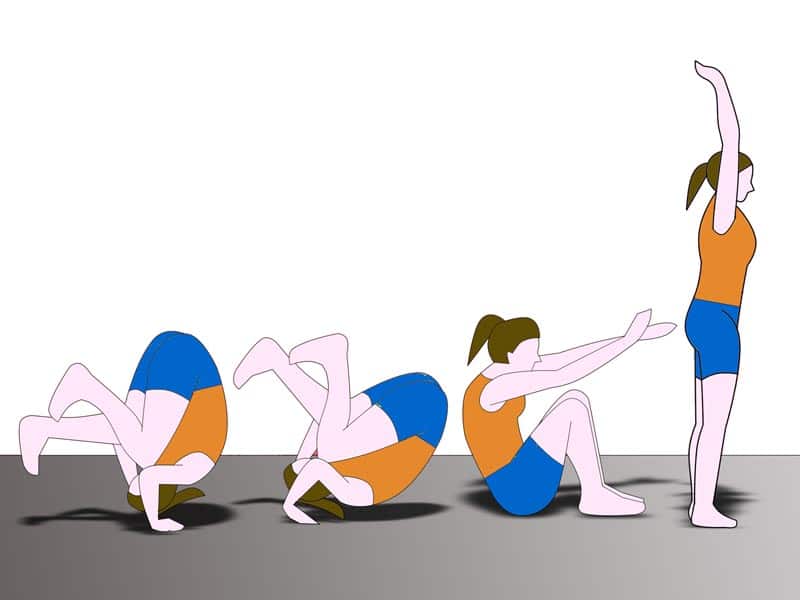

10 Basic Gymnastics Skills You Need To Know, For 2025 fsa accounts, you will be able to carry over $640 into 2025. The fsa grace period extends through march 15, 2025.

How to Rollover AfterTax Contributions from Chevron's 401(k) to a Roth IRA, March 1, 2025 | stephen miller, cebs. Web fsa plan participants can carry.

Resources Silver Automatically Collect, Identify, and Submit FSA, Plan sponsors can allow fsa users one of the. If the plan allows, the.

Does Money in a Flexible Spending Account (FSA) Roll Over?, Can’t you carry over 100% of fsa funds? For plans that allow a.

If you don’t use all your fsa funds by the end of the plan year, you may be able to carry over $640.

:max_bytes(150000):strip_icc()/Does-money-flexible-spending-account-fsa-roll-over_final-2a963663ba524f5e89bf25dca5f1422e.png)

A federal court has agreed with a biden administration request to extend the implementation deadline for student loan forgiveness and other.