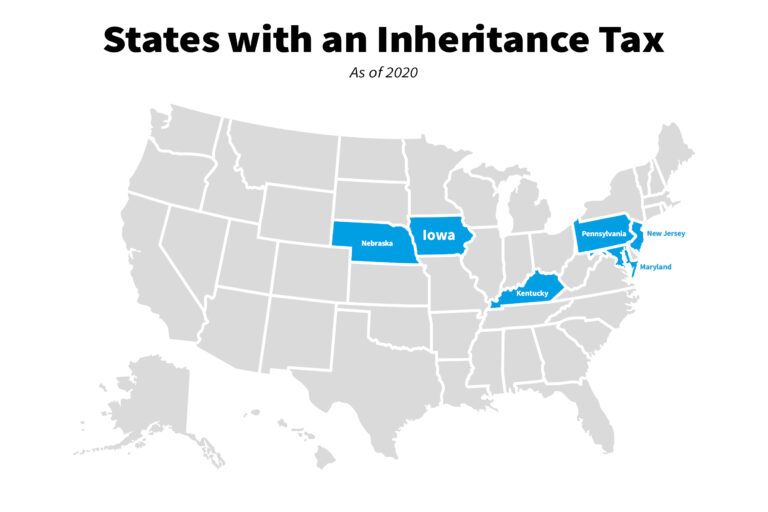

Which States Have Inheritance Tax 2025. Maryland is the only state in the country that levies both an estate tax and an inheritance tax. All six states with inheritance tax mandates including iowa exempt spouses.

Maryland is the only state in the country that levies both an estate tax and an inheritance tax. Eleven states, and the district of columbia, have an estate tax, while five states have an inheritance tax, where they tax people who live in their state when they.

How the government taxes rich dead people, explained Vox, Nebraska, iowa, kentucky, pennsylvania, maryland and new jersey. Iowa kentucky maryland nebraska new jersey pennsylvania why do you need to watch maryland?

Does California Have Inheritance Tax?, If the value of the assets being transferred is higher than the federal estate tax exemption (which is $13.61 million for tax year 2025 and $12.92 million for tax year 2025), the property can be subject to federal. There’s no federal inheritance tax and only six states collect an inheritance tax in 2025 and 2025, so it only affects you if the decedent (deceased person) lived or.

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/3634692/Estate_20and_20Inheritance_20taxes_0.0.png)

17 States that Charge Estate or Inheritance Taxes Alhambra Investments, Iowa kentucky maryland nebraska new jersey pennsylvania why do you need to watch maryland? This year, these states have an inheritance tax:

Which States Have Inheritance Tax? Mercer Advisors, Massachusetts and oregon have the lowest threshold for estate. Eleven states, and the district of columbia, have an estate tax, while five states have an inheritance tax, where they tax people who live in their state when they.

Which States Have Inheritance Tax? Mercer Advisors, Only six states have inheritance taxes: Nebraska, iowa, kentucky, pennsylvania, maryland and new jersey.

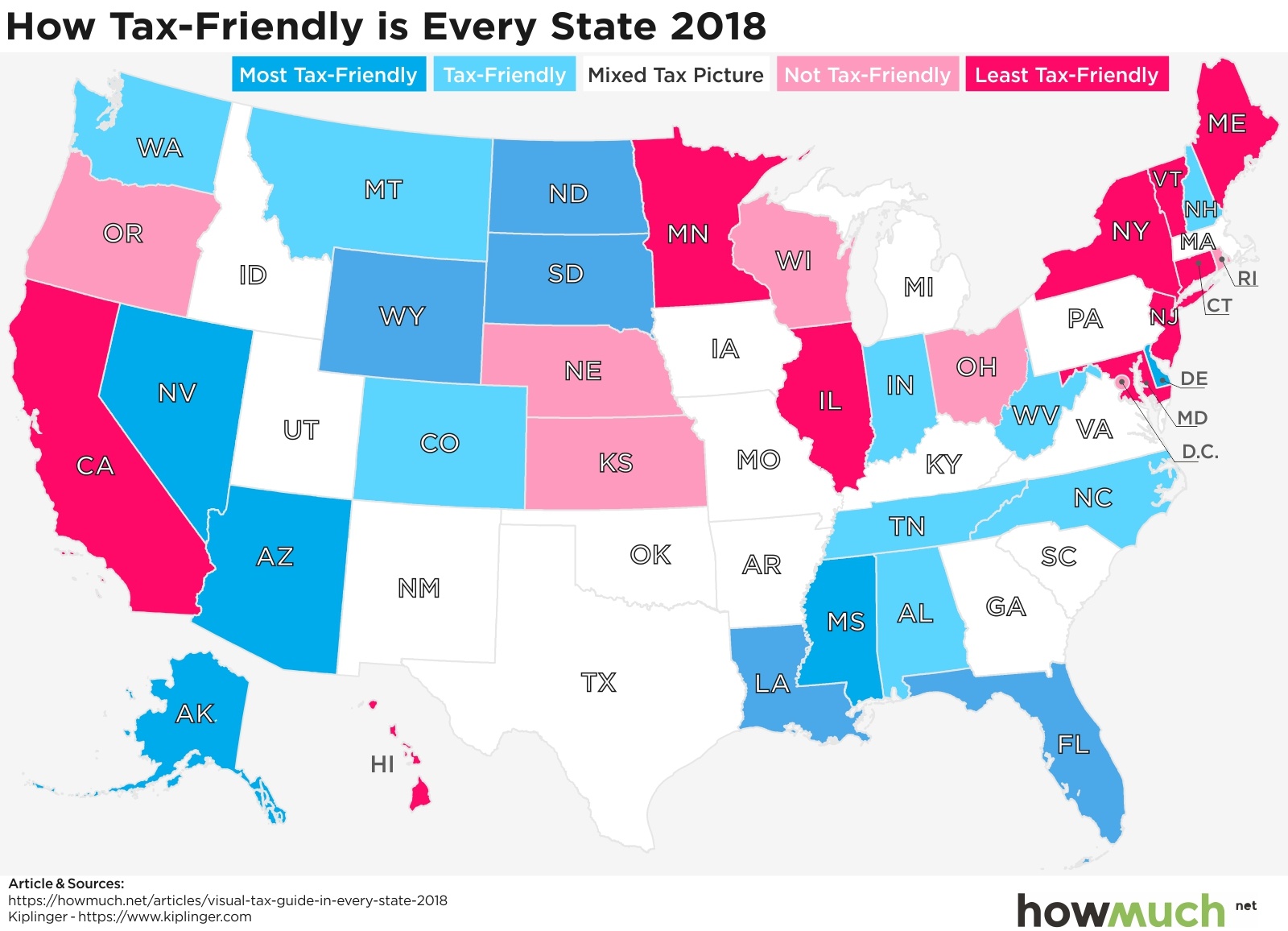

Visualizing Taxes by State, In 2025, states imposing inheritance tax include iowa, kentucky, maryland, nebraska, new jersey, and pennsylvania. The federal estate tax exemption is $13.61 million in 2025 and $12.92 million in 2025.

Does Your State Have an Estate or Inheritance Tax? Tax Foundation, What states have inheritance taxes? States don't collect an estate tax or an inheritance tax—often combined and known as the death tax—but several do.

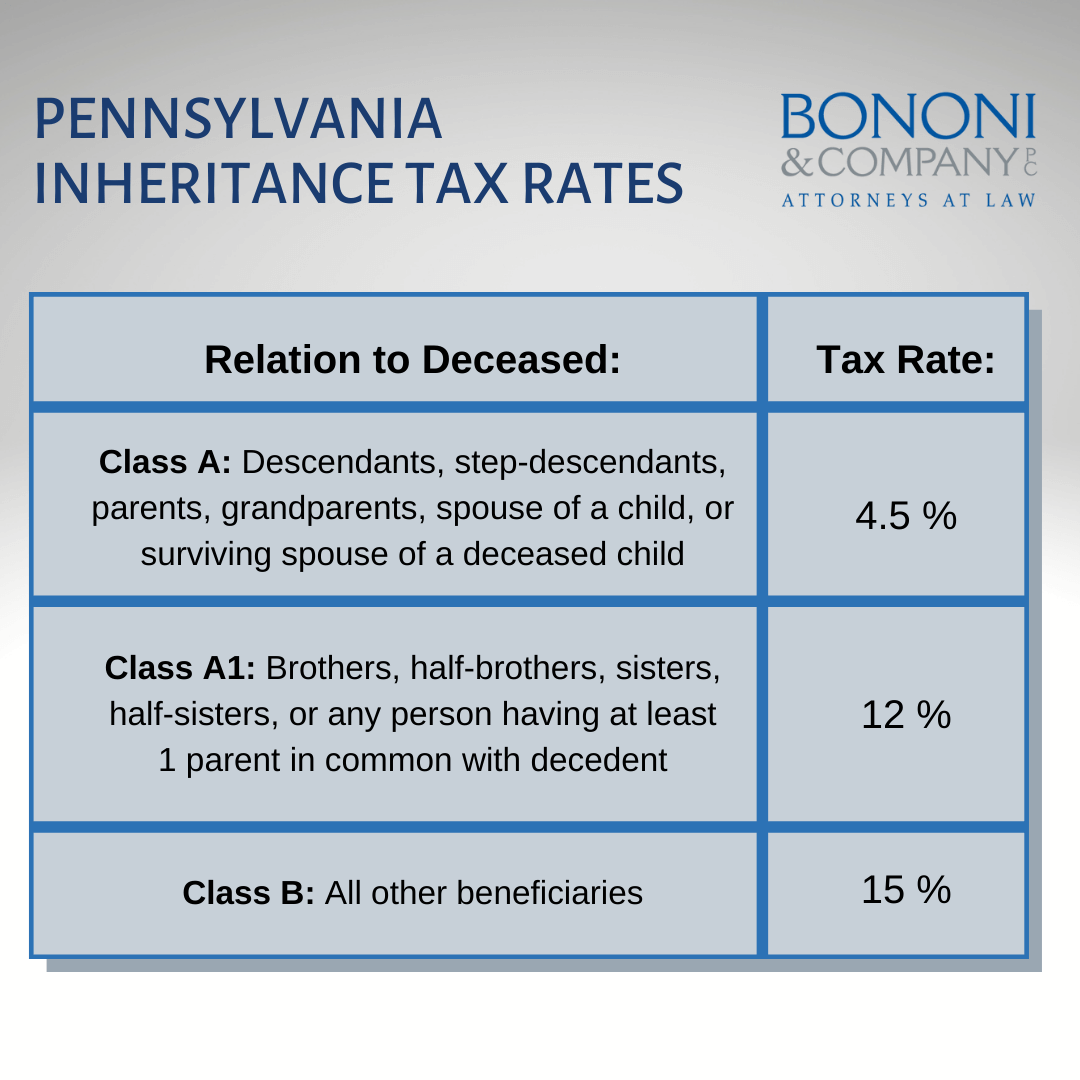

How To Avoid Pennsylvania Inheritance Tax Bononi and Company PC, The six states that impose an inheritance tax are iowa, kentucky, maryland, nebraska, new jersey and pennsylvania. There is no federal inheritance tax.

Federal Gift Tax vs. California Inheritance Tax, Iowa kentucky maryland nebraska new jersey pennsylvania why do you need to watch maryland? Currently, there is no pending legislation that would increase the state's estate tax exemption.

Eliminate Iowa’s Inheritance Tax Iowans for Tax Relief, Sure, unless you’re super wealthy, you’ll probably avoid the $13.61 million threshold for the federal estate tax, regardless of which state you die in. To sum up, the outlook for inheritance taxes in 2025 is largely optimistic for beneficiaries.

States don’t collect an estate tax or an inheritance tax—often combined and known as the death tax—but several do.